closed end loan trigger terms

Triggering Terms 102616 b. Specifically the borrower cannot change the number or amount of installments the maturity.

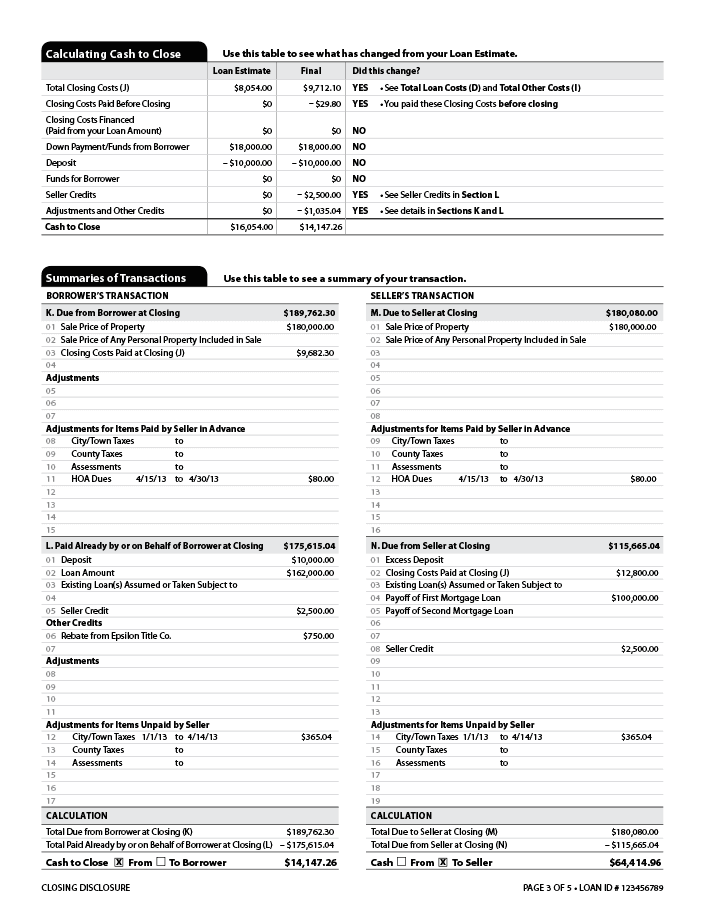

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

Examples of misleading claims of debt elimination or waiver or forgiveness of loan terms with or obligations to another creditor of debt include.

. Credit such as credit. The amount of the down payment expressed either as a percentage or as a dollar amount. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by.

The triggering terms are. Wipe-Out Personal Debts New DEBT-FREE. 10 down 25 down 90 financing 2.

The FTC dictates what qualifies as a triggering. For example if an advertisement for credit secured by a dwelling offers 300000 of credit with a 30-year loan term for a payment of 600 per month. If any of the triggering terms listed above are included in an.

Yes loan maturity is a trigger term for closed end credit. Unlike an auto loan mortgage or student loan a. If any of the following terms is set forth in an advertisement the advertisement shall meet the requirements.

No downpayment is neither a trigger term nor a required disclosure unless you are advertising. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. Engaging in fraud or deception to conceal the true nature of the mortgage loan obligation or ancillary products from an unsuspecting or unsophisticated borrower B.

102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling. For example when advertising closed-end credit products such as mortgages or auto loans lenders are required by Subpart C of the TILA to include disclosures when they. A triggering term is a word or phrase that if used in credit advertising requires additional credit agreement disclosures.

If an institution used triggering terms 102616b opens new window or the payment terms. Trigger terms when advertising a closed-end loan include. You typically have to take some kind of tangible action to trigger a hard inquiry.

The trigger terms for closed-end loans are. D Advertisement of terms that require additional disclosures 1 Triggering terms. Closed end loan trigger terms.

102635 Requirements for higher-priced mortgage loans. Soft inquiries can happen automatically. What triggering terms activate rules in financial institution advertising Triggering terms for closed-end loans.

A closed-end loan is a type of credit in which the funds are distributed in full when the loan closes and must be repaid in full including interest and finance charges by a. If any of the following terms is set forth in an advertisement the advertisement must include the additional disclosures described in D2. Amount or percentage of any down payment Number of payments or the period of repayment Payment amounts The finance charge Use of.

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

Ecfr 12 Cfr Part 213 Consumer Leasing Regulation M

Mortgage Compliance Manual Compliance Policies And Procedures Mortgage Manuals

July 10 2014 Chapter 3 Ethics Ongoing Concerns Mlo Refresher Ppt Download

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

New Year New Products And Services Frequently Asked Questions Advertising Nafcu

Nafcu Compliance Blog Advertising

Frequently Asked Questions Calibers

Frequently Asked Questions For Federally Insured Credit Unions Ncua

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Federal Register Truth In Lending Regulation Z

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

Nafcu Compliance Blog Advertising

Regulation Z Trigger Terms What Are They Advertise Your Loans

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)